Invest in Second Homes in 2024

Investment in property and investment in vacation homes are two distinct approaches to investing, each with its own benefits and considerations.

Investment in Residential Property

Steady Income Potential

Investing in residential or commercial properties can generate consistent rental income

through long-term leases or rentals. This option provides a reliable cash flow, appealing to

investors seeking regular returns. However, typical returns on investment range from 1% to 3% annually,

which are considered low, leading investors to reconsider traditional residential property investments.

Capital Appreciation and Gains

Real estate investments offer potential for property value appreciation over time. With strategic

location choices and smart investments, you can benefit from capital gains when selling the property in the future

Portfolio Diversification

Property investments contribute to portfolio diversification,

as real estate often has a low correlation with other asset classes like stocks or bonds.

This diversification helps mitigate risk and supports a balanced investment strategy.

Tangible Asset Ownership

Real estate investments provide the advantage of tangible assets

that you can physically own and control. This aspect appeals to investors who value direct ownership and the potential for property improvements and customization.

Vacation Home Investment

Personal Enjoyment and Prestige

Investing in a vacation home offers the dual benefit of personal enjoyment and pride of ownership.

You gain a dedicated space for vacations, weekend getaways, family gatherings, or hosting friends, adding emotional value beyond financial returns.

High Rental Income Potential

Vacation homes can generate substantial rental income when rented

out to tourists during non-use periods. Depending on location and demand,

these rentals can yield higher returns, especially during peak seasons. Generally,

vacation home investments can fetch returns of up to 6% to 15% annually

Tax Advantages

Owning a vacation home comes with potential tax benefits.

Under Section 80 EEA, you can claim income tax benefits of up to Rs. 1.5

lakh on home loan interest payments each year. These benefits are in addition to the existing exemption of Rs. 2 lakh under Section 24(b).

Appreciation and Lifestyle Investment

Like traditional property investments, vacation homes have

the potential to appreciate in value, offering capital gains upon sale. Moreover,

investing in a vacation home aligns with your desired lifestyle, allowing you to invest in a

location and experience that matches your personal preferences and budget.

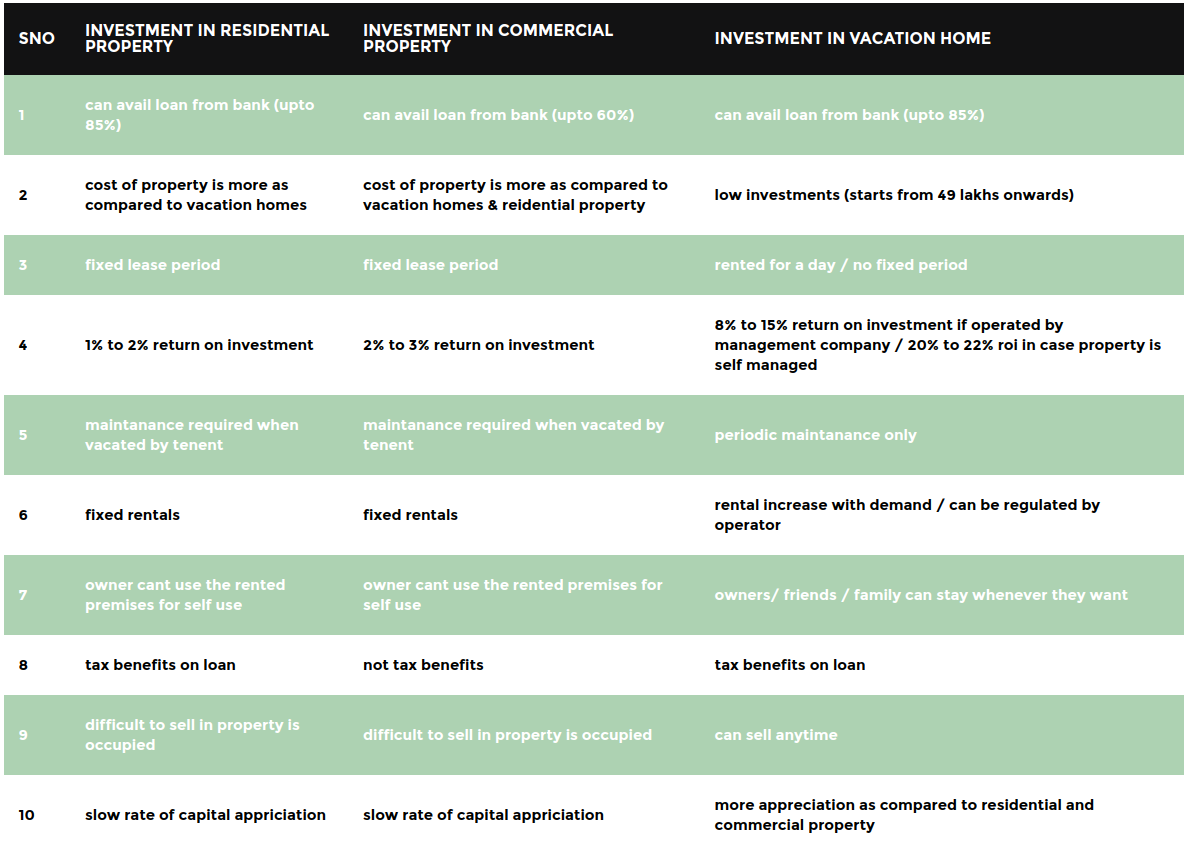

Comparison of Investment Between Residential Property Commercial Property and Vacation Homes